The smart Trick of Melbourne Finance Broker That Nobody is Talking About

Table of Contents8 Easy Facts About Best Financial Planner Melbourne ExplainedSome Ideas on Finance Brokers Melbourne You Need To KnowBest Financial Planner Melbourne Things To Know Before You BuyNot known Details About Best Financial Planner Melbourne Melbourne Finance Broking Can Be Fun For Anyone

The function of a Mortgage Broker can be confusing, particularly if you are an initial home customer. Knowledgeable home mortgage brokers play an essential function in functioning as the intermediator for you and readily available lending institutions. It pays to be mindful of the various benefits and drawbacks of collaborating with home loan brokers.Home loan brokers generally do not charge you a fee for their solution, but rather make commissions on finance they assist in setting up from the bank. They mainly earn money the same per bank, so you don't have to fret about your broker offering you biased mortgage items. Mortgage brokers will certainly recommend mortgage products that are lined up with your one-of-a-kind situation.

Shore Financial sticks out among all various other home mortgage brokers as the # 1 relied on partner that genuine estate agents are probably to advise in Australia. It has been granted the finest, large independent mortgage broker, which suggests you can trust that you're dealing with a broker that has the range, strength, and experience to combat for the very best offer for you.

Everything about Melbourne Finance Broking

There isn't a catch when it pertains to collaborating with a Home mortgage Broker, nevertheless, you do need to be cautious when choosing the right person. You ought to constantly inspect their experience and credentials - best financial planners melbourne. It is likewise vital to know that they have partnerships with several lending institutions to ensure that you have plenty of alternatives when it involves choosing a loan provider

You require to feel great that they have your best passions in mind and that they will be able to support you with an extremely important financial decision. You may have friends or relative that have a suggestion for you, or else, you can look at your present network of financial companies.

As a not-for-profit organisation with a lot of links in the market, we always have your benefits in mind.

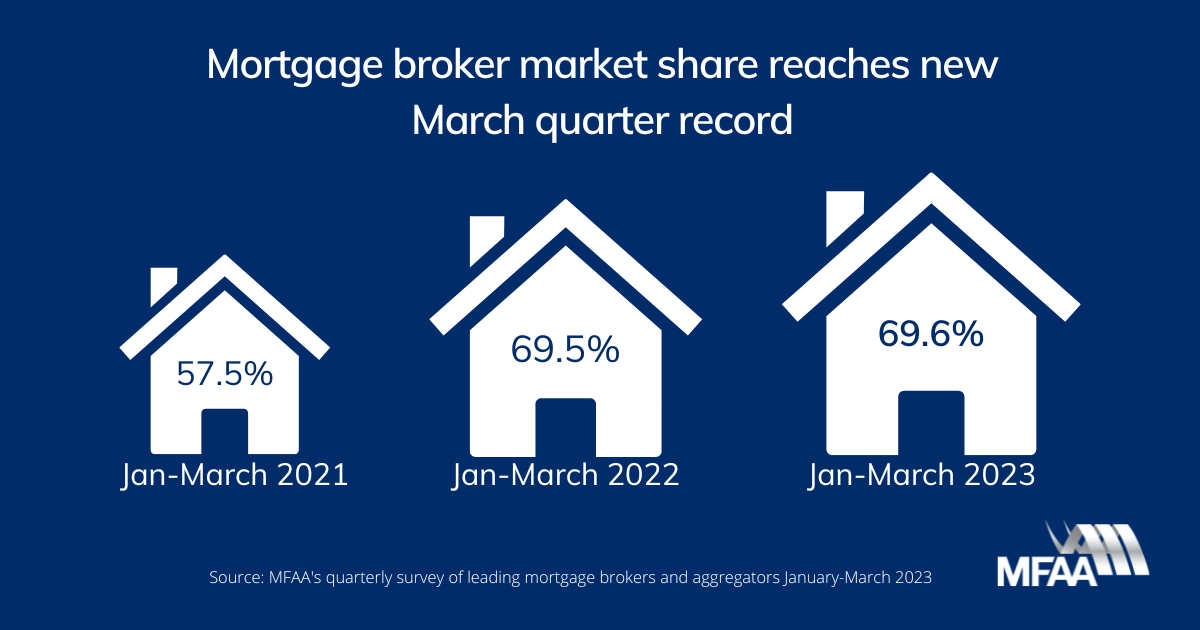

Traditionally, financial institutions and various other financing institutions have marketed their own items. As markets for home loans have become more affordable, nevertheless, the duty of the home loan broker has come to be extra preferred.

How Best Financial Planner Melbourne can Save You Time, Stress, and Money.

Home loan brokers exist to discover a financial institution or a straight lender that will be eager to make a particular lending an individual is looking for. Mortgage brokers in Canada are paid by the loan provider and do not bill costs for excellent credit scores applications.

Numerous states require the mortgage broker to be licensed. States manage financing technique and licensing, and the policies differ from one state to another. A lot of states require a license for those persons that want to be a "Broker Partner", a "Broker agent Service", and a "Straight Lending institution". A home mortgage broker is generally registered with the state, and is personally liable (punishable by abrogation or jail) for fraudulence for the life of a car loan.

Car loan police officers who work for a depository organization are called for to be signed up with the NMLS, yet not certified. Normally, a mortgage broker will make more cash per funding than a car loan police officer, however a loan police officer can utilize the referral network available from the borrowing organization to sell more fundings.

The broker will certainly then assign the finance to a designated certified lending institution based upon their rates and closing rate. The lender may close the car loan and service the lending. They may either money it completely or briefly with a stockroom credit line prior to offering it right into a larger lending swimming pool.

The Best Strategy To Use For Finance Brokers Melbourne

They repay their stockroom lender, and acquire an earnings on the sale of the lending. The borrower will certainly typically obtain a letter informing them their lender has actually marketed or moved the lending. Lenders that sell many of their loans and do not really service them remain in some territories called for to inform the customer in creating.

This has produced an uncertain and difficult recognition of the true price to get a home loan. The federal government developed a brand-new Great Belief Price quote (2010 version) to permit customers to compare apples to apples in all fees associated to a home loan whether you are shopping a home mortgage broker or a straight lender.

Unclear for the home mortgage brokers to divulge this, they choose what charges to charge ahead of time whereas the straight lending institution will not know what they make general up until the car loan is offered. Often they will certainly market the loan, yet continue to service the financing.

Melbourne Finance Broker Can Be Fun For Everyone

Home loan lenders do not take down payments and do not find it sensible to make loans without a wholesaler in area to buy them. The necessary money of a mortgage lender is only $500,000 in New York. That quantity is sufficient to make only two average rate home fundings.